Workfare Income Supplement (WIS)

-

What are the enhancements to the Workfare Income Supplement Scheme?

The Government will enhance Workfare from Work Year 2023:- Qualifying monthly income cap raised from $2,300 to $2,5001. This takes into account income growth of Singaporeans.

- Extension of Workfare to those aged 30 - 34. The payments will help them better cope with their expenses and to start saving early for their retirement.

- Higher annual Workfare payments of up to $4,200. Payments depend on age and income, and have been enhanced across all age bands. Eligible employees can receive up to $4,200 per year in payments, compared to $4,000 per year today. Older workers will continue to receive the highest payments. The payments for self-employed persons are set at two-thirds of employee payments and will be correspondingly increased.

- All persons with disabilities (PWDs) will qualify for the highest Workfare payment tier (up to $4,200), regardless of age.

- Minimum qualifying monthly income criterion of $500. To encourage regular employment, Singaporean workers will need to earn at least $500 per month to qualify for Workfare.

Why will Workfare enhancements only take place in 2023?

Implementing the Workfare enhancements in 2023 provides sufficient time to make the required system changes, for smooth implementation of the enhancements.

The current Workfare criteria, which only came into effect two years ago in 2020, will continue to apply for work done in 2022.What is the Workfare Income Supplement scheme?

The Workfare Income Supplement (WIS) scheme was introduced in 2007 as a permanent feature of Singapore's social security system. The support is targeted at lower-wage Singaporean workers whose earnings are in the bottom 20% of the working population and is reviewed regularly to ensure that it meets the needs of Singaporeans. The 2023 WIS benefits had been reviewed and enhanced for eligible workers to receive support via cash and CPF contributions to supplement their income and retirement savings.Am I eligible for the Workfare Income Supplement scheme?

You will be eligible for the Workfare Income Supplement (WIS) scheme if you:- are a Singapore Citizen;

- are at least 30 years old or older on 31 December of the Work Year (WY) (including all persons with disabilities);

- earn a gross monthly income1 of at least $5002, but not more than $2,500 (previously $2,300) for the month worked and in the past 12 months3 (average monthly income) as an employee; or have an average monthly income of at least $5002, but not more than $2,500 (previously $2,300) as a Self-Employed Person (SEP);

However, you will not be eligible for WIS if you:- live in a property with an annual value4 of more than $13,000 assessed as at 31 December of the previous year;

- own two or more properties; or

- if you are married,

- you and your spouse together own two or more properties; or

- the assessable income of your spouse exceeds $70,000 for the previous Year of Assessment.

1 Includes basic salary and extra wages such as overtime pay, commissions and bonuses

2 Persons with disabilities and workers who qualify for ComCare Short-to-Medium-Term Assistance will qualify for concessionary WIS, even if they earn less than $500

3 Defined as income earned in the past 12-month period ÷ Total number of months worked in the past 12-month period

4 Annual value is the estimated gross annual rent of the property if it were to be rented out, excluding furniture, furnishings and maintenance fees. It is determined based on estimated market rentals of similar or comparable properties

How can I check the amount of Workfare Income Supplement that I will receive?

You will be notified of the Workfare Income Supplement (WIS) amount by letters and/or SMS messages nearer to the payment date.

To retrieve a copy of your notifications, please login to the Workfare portal at workfare.gov.sg with your Singpass.

If you are currently receiving your notifications via letter and wish to receive your notifications earlier via SMS, simply opt-in to SMS at "Notification".

You may also use the WIS calculator to estimate the amount of WIS you are entitled to.What do I need to do to receive Workfare Income Supplement (WIS)?

If you are an employee, you do not need to do anything. Your eligibility for Workfare Income Supplement (WIS) will be automatically assessed based on the CPF contributions* made by your employer.

If you are a Self-Employed Person (SEP), you need to declare your net trade income (NTI) and contribute to your MediSave Account to be considered for WIS. Use our online WIS calculator to find out the amount you need to contribute to your MediSave Account.

*Under the CPF Act, employers must contribute CPF if their employees earn more than $50 a month, regardless of whether the employee is employed on a permanent, part-time, contract or casual basis. If your employer is not contributing CPF on your behalf, please approach your employer to clarify on the discrepancies. If your employer does not provide you with a satisfactory response, you can lodge a report with CPF Board.When will I receive my Workfare Income Supplement payments?

You will receive Workfare Income Supplement (WIS) payments for every month that you work. The payment will be made two months after the work period. For example, the WIS payment for work done in January will be paid out in end March.

If you are an eligible Self-Employed Person (SEP), you will receive WIS payment once a year for work done in the preceding work year.If you worked in You will receive the WIS payment in * Jan End Mar Feb End Apr Mar End May Apr End Jun Month x End of month (x+2)

* Payment via PayNow NRIC-linked bank account or bank crediting will be credited by end of the month while payment via GovCash will be on the 3rd of the following month.Whom can I contact for queries about the Workfare Income Supplement scheme?

You can contact CPF Board via the following channels for your Workfare Income Supplement scheme enquiries:- Write to us via our Online Enquiry Form

- Write to us via My Mailbox using your Singpass log in

How can I change the mode of payment for my Workfare Income Supplement (WIS) payment?

If you have a PayNow NRIC-linked bank account, it will be the default mode of payment. To link your NRIC number to your bank account, you may follow the steps below:

1. Set up internet / mobile banking with your bank

2. Log in to your bank's internet / mobile banking application

3. Link your NRIC number to your bank account at the PayNow registration screen

You may also refer to your bank's website for specific details to do so. If you not have Internet or mobile banking, you can contact your bank directly to register for PayNow.

If you do not have a PayNow NRIC-linked account, and wish to receive your payment via bank crediting, you may update your bank account details by logging into the Workfare Portal at workfare.gov.sg.How much Workfare Income Supplement (WIS) will I get?

The Workfare Income Supplement (WIS) payment depends on your age and income. You may use the online WIS calculator to estimate the amount of WIS you will receive.

As announced at Budget 2022, WIS will be enhanced from Work Year 2023. Click here to find out more about the upcoming WIS enhancements.

Your age in the work yearMaximum WIS per year If you are employed If you are self-employed In 2022 From 2023 In 2022 From 2023 30 - 34 (new tier) - $2,100 - $1,400 35 - 44 $1,700 $3,000 $1,133 $2,000 45 - 54 $2,500 $3,600 $1,667 $2,400 55 - 59 $3,300 $2,200 60 and above $4,000 $4,200 $2,667 $2,800 All persons with disabilities (PwDs) Varies by age $4,200 Varies by age $2,800 Will I receive Workfare Income Supplement (WIS) if I am unemployed?

The Workfare Income Supplement (WIS) scheme supplements the income and CPF savings of lower-income Singaporeans, and encourages them to enter and remain in the labour market.

You would not receive WIS if you are not working.

If you require assistance in looking for a job, or are seeking information on training and skills upgrading, please approach any of the Distributed CareerLink Networks run by the Community Development Councils (CDCs). Alternatively, you can call Workforce Singapore (WSG) hotline at 6883 5885.How do I appeal for Workfare Income Supplement (WIS) Scheme?

You can send in your appeal for Workfare Income Supplement (WIS) via the online enquiry page:

- Select "Workfare Income Supplement (WIS)" under Subject

- Select "Appeal-WIS" under Category

When can I receive the Workfare Income Supplement (WIS) Scheme payment after making the required MediSave contributions?

We will assess your eligibility for Workfare Income Supplement (WIS) in the month after you have made your MediSave contributions in full. You will receive an SMS notification and/or letter at the end of the assessment month on the WIS payment details if you are eligible.How do I stop receiving hardcopy notifications for the Workfare Income Supplement scheme?

If you wish to receive notifications of your Workfare Income Supplement (WIS) payments by SMS rather than hardcopy letters, please log in to the Workfare Portal with your Singpass and opt-in to SMS at “Notification”.How do I adjust my net trade income (NTI) for the Workfare Income Supplement scheme?

If you have previously declared your net trade income (NTI) to the Inland Revenue Authority of Singapore (IRAS), please call them at 1800-356 8300 if you wish to adjust your NTI for your Workfare Income Supplement scheme (WIS).

Alternatively, you can contact them via these other channels. Please inform CPF Board once IRAS has reassessed your NTI and CPF Board will update your NTI and MediSave payable for WIS.When must I declare my net trade income and pay the MediSave contributions to be eligible for the Workfare Income Supplement Scheme for work done in 2021/2022?

To be eligible for the Workfare Income Supplement (WIS) scheme for work done in 2021/2022, please declare your 2021/2022 net trade income and contribute to your MediSave Account by 31 December 2023/2024.Why are Singapore Permanent Residents (PRs) not eligible for the Workfare Income Supplement scheme?

The Workfare Income Supplement (WIS) scheme is only for Singaporean lower-wage workers with limited household wealth.

If you require financial assistance, please contact ComCare hotline 1800-222-0000, or email Ask_SSO@msf.gov.sg.Are inmates eligible for the Workfare Income Supplement scheme?

Inmates who have worked while serving their sentences may be eligible for the Workfare Income Supplement (WIS) scheme as Self-Employed Persons (SEPs) by making voluntary MediSave contributions based on the income earned during incarceration. The Singapore Prison Service will furnish inmates' work records to the Board in the following year and inmates’ family members may make the MediSave contributions to the Board on behalf of the inmates.How much cash and CPF top-ups will I receive from the Workfare Income Supplement scheme?

If you are an employee, you will receive 60% of your Workfare Income Supplement (WIS) in CPF contributions and the remaining 40% in cash.

A higher proportion is credited into your Special and MediSave Accounts to boost your retirement and healthcare savings, as savings in these accounts earn up to 5% per annum if you are below 55, and up to 6% per annum if you are 55 or above.

You can refer to the table below on the allocation of the WIS CPF payment into the three accounts, according to the age bands.

Age

(Years)Ordinary Account MediSave Account Special Account 35 & below 0.3000 0.3500 0.3500 Above 35 - 45 0.2856 0.3711 0.3433 Above 45 – 50 0.2785 0.3816 0.3399 Above 50 – 55 0.2498 0.3751 0.3751 Above 55 – 60 0.4315 0.4545 0.1140 Above 60 – 65 0.2080 0.6384 0.1536 Above 65 0.0784 0.8408 0.0808

If you are a Self-Employed Person, you will receive 90% of your WIS in your MediSave account and the remaining 10% in cash.How will I receive the cash portion of my Workfare Income Supplement?

The cash portion of Workfare Income Supplement (WIS) will be credited to your PayNow NRIC-linked bank account if you have one.

Otherwise, it will be credited to the DBS/POSB, OCBC or UOB bank account that you have registered to receive Government payments (e.g. either the GST-Voucher (GSTV), Silver Support Scheme (SSS) or WIS, whichever is latest) or via GovCash if you had not registered a bank account with us.

Electronic payments make transactions simple, swift, and safe for recipients. We strongly encourage you to consider linking your NRIC number to your PayNow bank account, or update your bank account with us*.

*If you have linked your NRIC number to your PayNow bank account after the 16th of the month, or submitted your bank account details after the 14th of the month, your updates will only be effective in the following month.How can I declare my income as a Self-Employed Person?

Declare your net trade income to:

- the Inland Revenue Authority of Singapore (IRAS) if you have been issued an income tax return package; or

- the CPF Board if you have not been issued an income tax return package, by logging in to the CPF website with your Singpass to complete and submit the Self-Employed Person Income Declaration Form by 18 April. After 18 April, please write to us for us to process your income declaration.

-

My employer does not pay my CPF. What can I do to qualify for Workfare Income Supplement (WIS)?

Under the CPF Act, employers must contribute CPF if their employees earn more than $50 a month, regardless of whether the employee is employed on a permanent, part-time, contract or casual basis.

If your employer is not contributing CPF on your behalf, please approach your employer to clarify on the discrepancies. If your employer does not provide you with a satisfactory response, you can lodge a report with CPF Board.I am earning close to $2,500, why are my Workfare Income Supplement payments so low?

The Workfare Income Supplement (WIS) scheme is targeted at older, lower wage Singaporean workers whose earnings are in the bottom 20% of the working population, with support also available for those earning slightly more.

To best support lower wage workers, the WIS benefits are gradually reduced as the income levels of the workers increase nearer to the qualifying amount of $2,500. The gradual reduction ensures that the lower-wage workers do not see a sharp reduction in their WIS benefits when they upgrade their skills and begin to earn more. Taken together, the total amount of the income and the WIS payments would still increase overall as one's income increases.

I am earning $50 or less per month. What do I need to do to receive the Workfare Income Supplement (WIS)?

You will be eligible for Workfare Income Supplement (WIS) if you meet all the other eligibility criteria and make voluntary CPF contributions for the monthly wages (where CPF contribution is exempted).

The voluntary CPF contribution amount varies, depending on one's age and the prevailing CPF contribution rates. Please write to us with your particulars and supporting documents (i.e. payslips/employer's letter) so we can advise you on the amount to contribute:

On the online enquiry page,

- Select "Workfare Income Supplement (WIS)" under Subject

- Select "General Enquiry-WIS" under Category

We will review your WIS eligibility after we have received your request and supporting documents.I am a contract / part-time employee. Will I be eligible for Workfare Income Supplement?

Contract / part-time employees are eligible for the Workfare Income Supplement (WIS) if they meet the WIS eligibility criteria.I am on no-pay/study/medical/maternity leave. Will I be considered as employed to qualify for Workfare Income Supplement?

For the purposes of Workfare Income Supplement (WIS), staff on study/medical/maternity leave will be considered as employees if you are still receiving a salary and CPF contributions from your employers.Of the Workfare Income Supplement payment to my CPF, what is the proportion credited into the various CPF accounts?

Workfare Income Supplement (WIS) is paid partially in cash to help you with your immediate expenditure, and partially into your CPF accounts to boost your retirement adequacy. Up to age 55, a higher proportion is credited into your Special and MediSave Accounts to boost your retirement and healthcare savings respectively. After age 55, similar to employees, the majority of the contributions will go towards MediSave, with smaller proportions going towards the other two accounts.

You can refer to the table below on the proportion of the WIS CPF payment credited into the three accounts, according to the age bands.

Age

(Years)Ordinary Account MediSave Account Special Account 35 & below 0.3000 0.3500 0.3500 Above 35 - 45 0.2856 0.3711 0.3433 Above 45 – 50 0.2785 0.3816 0.3399 Above 50 – 55 0.2498 0.3751 0.3751 Above 55 – 60 0.4315 0.4545 0.1140 Above 60 – 65 0.2080 0.6384 0.1536 Above 65 0.0784 0.8408 0.0808 How is my income calculated for the Workfare Income Supplement (WIS)?

We will calculate your income based on the CPF contributions made by your employer(s) for work done in that month.

-

Who is a Self-Employed person (SEP)?

A Self-Employed Person (SEP) is any individual who derives income from Singapore or from outside Singapore through any trade, business, profession or vocation excluding employment under a contract of service.

If you earn an income by buying and selling goods or providing professional or personal services, you are a SEP. Examples of Self-Employed Persons include hawkers, taxi drivers, freelancers, sole proprietors or a partner in a partnership.

Visit the Inland Revenue Authority of Singapore (IRAS) website to read more on the definition of a SEP.Why do Self-Employed Persons receive only two-thirds of the Workfare Income Supplement (WIS) received by employees?

The CPF contribution made by Self-Employed Persons (SEPs) is comparatively lesser than employees who earn the same amount. SEPs are only required to contribute to their MediSave Account whereas employees need to contribute to all their CPF Accounts (Ordinary, Special and MediSave Accounts).Why do employees receive monthly Workfare Income Supplement (WIS) payments while Self-Employed Persons receive their WIS once a year?

The incomes of employees are automatically computed based on their monthly CPF contributions from their employers. This enables CPF Board to assess their Workfare Income Supplement (WIS) eligibility automatically and disburse their WIS payments on a monthly basis.

On the other hand, the net trade income (NTI) of a Self-Employed Person (SEP) is assessed over an entire year and can only be determined the following year after the current year has ended.Why must Self-Employed Persons (SEPs) contribute to MediSave to receive Workfare Income Supplement (WIS)?

A key principle of the Workfare Income Supplement (WIS) scheme is that each recipient has a personal responsibility to save for his future needs, with the Government providing additional support.

Self-Employed Persons (SEPs) are required to contribute to their MediSave Accounts as they do not receive regular MediSave contributions from employers. It is important to contribute regularly to ensure enough savings for healthcare needs. This is especially important during old age, when SEPs may have stopped working.

WIS is intended to supplement, not replace the MediSave contributions made by the SEPs.What are the payment modes for making MediSave contributions?

There are several ways you can make your MediSave contributions.

The most convenient way is via GIRO, which allows automatic monthly deductions from your bank account. You may apply to pay via GIRO online (if you have a bank account from OCBC/DBS/POSB) or by mail (for other banks).

The payment options are:Payment Mode Details GIRO Online using my cpf Online Services

1. Log in with your Singpass.

2. Submit the "Apply/Change GIRO for Mandatory MediSave Contributions and Voluntary Contributions by Self-Employed Person" application.

3. Check your GIRO application status via My Activities.

Mail

1. Download and complete the

"Apply for GIRO for Mandatory Contributions or Voluntary Contributions" form (FORM GIRO SE/VC (PDF, 0.6MB)).

2. Mail it to the address printed overleaf of the GIRO application form.

3. We will notify you of your GIRO application status once the bank has processed it.e-Cashier • PayNow QR

• eNETS Debit - payment by DBS/POSB, OCBC, Standard Chartered Bank or United Overseas Bank internet bankingNETS/CashCard • Pay by NETS or CashCard at any SingPost branches

The service standard for processing electronic payment is as follows:

- For payment via PayNow QR, your payment will be processed almost immediately.

- For payment via eNETS Debit, your payment will be processed within the next working day.

- Check that your MediSave contribution is reflected in My Statement, or

- Check the transaction status under My Activities (if you paid via e-Cashier)

I have made the required MediSave contribution to qualify for Workfare Income Supplement, why is my payment still not reflected in the MediSave Payable page after logging into e-service?

Contributions made each month will be updated in e-service on the 9th working day of the following month.I am a homemaker/caregiver/babysitter. Can I qualify for the Workfare Income Supplement scheme?

The objective of the Workfare Income Supplement (WIS) scheme is to supplement the retirement savings and incomes of older and lower-wage Singaporeans, and to encourage them to work regularly.

A person may be eligible for WIS if he is engaged in work that draws an income.

Allowances received for carrying out family support roles such as babysitting and caregiving for dependents are considered transfers within the family. They are not external sources of income derived from employment, hence it would not be appropriate to consider these transfers for WIS.

The Government recognizes that such family roles are important. There are other forms of government support for these roles, such as the Marriage and Parenthood package which provides broad-based support for couples to raise and care for their children.I am a freelancer/conducting a home business (e.g. baking, sewing). Can I qualify for the Workfare Income Supplement scheme?

You are considered a Self-Employed Person (SEP) and you will need to register your SEP status with CPF Board, declare your net trade income, and contribute to your MediSave Account. You will also need to meet the Workfare Income Supplement (WIS) scheme eligibility criteria in order to qualify for WIS.

To conduct a home business, you need to follow the guidelines under HDB's Home-Based Small-Scale Business Scheme.

Please refer to the Housing & Development Board's website for more information.My annual trade income from self-employment in a work year was negative (i.e. I incurred a loss). Can I use the trade losses to offset against my income in the following year for the purpose of Workfare Income Supplement (WIS)?

Workfare Income Supplement (WIS) is based on your actual net trade income earned in the work year and does not include previous year's losses.My annual trade income from Self-Employment in a work year was negative. Can I qualify for the Workfare Income Supplement scheme?

You will be required to contribute the minimum amount of MediSave to qualify for the Workfare Income Supplement (WIS) scheme. Please use the Workfare calculator to estimate the minimum MediSave contribution and your WIS amount.

You will receive your WIS payment within two months after you have declared your net trade income and made the required MediSave contribution.What do I need to do to receive Workfare Income Supplement if I am a Self-Employed Person?

You will be eligible for Workfare Income Supplement (WIS) if you meet all the eligibility criteria and:

- declare your income to:

- the Inland Revenue Authority of Singapore (IRAS) if you have been issued an income tax return package; or the CPF Board if you have not been issued an income tax return package, by logging in to the CPF website with your Singpass to complete and submit the Self-Employed Person Income Declaration Form by 18 April. After 18 April, please write to us for us to process your income declaration.

- make the required MediSave contributions. You can use our online WIS calculator to find out the amount to contribute.

- declare your income to:

-

I worked as both an employee as well as a Self-Employed Person in the work year. When will I receive my Workfare Income Supplement for the work year?

You will receive monthly Workfare Income Supplement (WIS) payments based on your employee income if you meet the WIS eligibility criteria for the work year (WY).

If you are also an eligible dual status worker (DSW) who has worked concurrently as a SEP and employee in the year, you may receive additional WIS if your combined employment and net trade income results in a higher WIS payment. You will receive your WIS top-up after you have declared your income (to IRAS or CPFB) and have made the required MediSave contributions.

You will receive the WIS top-up once a year for work done as a Self-Employed Person in the preceding year.

-

To qualify for Workfare Income Supplement, what is considered income?

Employee income is based on the definition of Gross Wages under the CPF Act:

Total Gross Wages = Total Ordinary Wages + Total Additional Wages

Where:

Ordinary Wages are wages due or granted wholly and exclusively in respect of an employee's employment in that month and payable before the due date for payment of CPF contributions for that month.

Additional Wages are wages which are not granted wholly and exclusively for that month. Examples are annual bonus, leave pay and other payments made at intervals of more than a month.

Total Wages are the total amount of an employee's wages for any calendar month, which is the sum of his Ordinary Wages for the month and the Additional Wages paid to him in that month.Why are overtime pay and bonuses included in Workfare Income Supplement assessment?

Basic salary, overtime pay, and bonuses are part of a worker’s total income that will help support the worker and his or her family. Given that the Workfare Income Supplement (WIS) is intended to supplement the income of lower wage workers, it is most useful to assess the total income in determining one’s eligibility for WIS.Why am I not eligible for Workfare Income Supplement despite my gross monthly income being less than $2,500 as an employee?

Gross monthly income includes salary (before deduction of CPF contribution), bonuses, allowances and overtime pay received during the work period.

Other than gross monthly income, you must also earn an average gross monthly income of not more than $2,500* in the past 12 months.

The average gross monthly income is defined as:

Sum of income earned in the past 12-month period ÷ Total number of months worked in the past 12-month period

Can the minimum income criterion be waived for workers who want to work more but are unable to?

The minimum income criterion of $500 per month was introduced from 2023 to encourage all workers, part-time and full-time, to work more regularly or take up higher-paying jobs.

$500 per month is a reasonable and achievable wage for most regular workers. At an hourly wage of $9 per hour1, workers who work 3-hr daily shifts for 20 days a month would already earn around $540 per month.

However, we recognise that there may be some who want to work more but are unable to do so due to their personal circumstances or are in greater need of support, such as Persons with Disabilities (PWDs), low-income workers who qualify for ComCare Short-to-Medium-Term Assistance and caregivers of care recipients2. Such workers will continue to qualify for concessionary WIS, even if they earn less than $500 per month.

1 Based on Local Qualifying Salary

2 This will generally include caregivers residing with care recipients who are medically certified to have permanent moderate to severe disabilities. More details on the concessionary WIS for caregivers will be provided later.

I am a Person with Disability/Comcare Short and Medium Term Assistance recipient who is learning less than $500 per month. How much WIS will I receive?

You will continue to qualify for concessionary WIS, even if you earn less than $500 per month. We will notify you of the amount nearer to the payment dates.

-

Do residents in welfare homes qualify for Workfare Income Supplement (WIS)?

Residents in welfare homes registered with the National Council of Social Service/ Ministry of Health/ Ministry of Social and Family Development will qualify for Workfare Income Supplement (WIS) if they meet all of the other WIS eligibility criteria.Why is the Annual Value of my place of residence used to assess my eligibility for Workfare Income Supplement?

The Annual Value (AV) serves as a housing criterion that targets lower-wage workers from lower income households.

Using AV instead of housing type is a fairer way to determine property value as some applicants may be staying in smaller and less expensive private properties with an AV similar to a larger Housing & Development Board flat.

What is the Annual Value of a property?

Annual Value (AV) is the estimated gross annual rent of the property if it were to be rented out, excluding furniture, furnishings and maintenance fees. It is determined based on estimated market rentals of similar or comparable properties. It can be found on the property tax bill you receive each year.

For more information on the computation of AV, please visit the Inland Revenue Authority of Singapore (IRAS) website.How is the Annual Value (AV) requirement for Workfare Income Supplement (WIS) decided?

The Annual Value (AV) threshold of $13,000 covers all HDB flats, as well as some smaller private residences. In general, Singaporeans staying in larger properties with AV above the cut-off tend to have greater access to household wealth, and therefore would not be eligible for the Workfare Income Supplement Scheme.What address is used to determine the Annual Value in Workfare Income Supplement (WIS) assessment?

The Annual Value will be based on the address reflected in your NRIC. Under the National Registration Act, you must report a change of address within 28 days of moving at any police station, or the Immigration & Checkpoints Authority (ICA) website.I disagree with my Annual Value assessment. What do I need to do to receive Workfare Income Supplement (WIS)?

You may approach the Inland Revenue Authority of Singapore (IRAS) for a re-assessment. If the Annual Value of your property is subsequently re-assessed and meets the housing criterion, you may then appeal for Workfare Income Supplement.I am renting a room/whole unit in the property that I stay in. Am I eligible for Workfare Income supplement (WIS)?

If you are renting the entire property unit, the annual value of that property unit will be used to assess your eligibility.

If you are renting only a room or some rooms in the property, please write to us with your tenancy agreement and particulars (name, NRIC, telephone number, address and the nature of your appeal) on the online enquiry page:- Select "Workfare Income Supplement (WIS)" under Subject

- Select "Appeal-WIS" under Category

We will review your Workfare Income Supplement eligibility after we have received your request and the supporting documents.The Annual Value of my place of residence has been revised (e.g. moved house). What do I need to do to receive Workfare Income Supplement?

We will review your case if you update your NRIC address within 28 days of your change of address. Please write to us with your particulars and supporting documents on the online enquiry page:- Select "Workfare Income Supplement (WIS)" under Subject

- Select "Appeal-WIS" under Category

We will review your Workfare Income Supplement eligibility after we have received your request and the supporting documents.What constitutes a second property for Workfare Income Supplement Scheme?

All types of properties e.g. Housing & Development Board flat, private property and non-residential property, are taken into account in determining the eligibility for Workfare Income Supplement Scheme.

-

Why is my spouse's income and property ownership used to determine my eligibility for Workfare Income Supplement (WIS)?

To ensure that Workfare Income Supplement (WIS) is targeted at recipients with limited access to household wealth, you will not qualify for WIS if :- the assessable income of your spouse for the preceding Year of Assessment exceeds $70,000; or

- you and your spouse together own two or more properties.

Why is my spouse's Assessable Income for the preceding Year of Assessment used to determine my Workfare Income Supplement (WIS) eligibility for the current work year?

This is to allow potential Workfare Income Supplement (WIS) recipients to receive WIS earlier despite the time needed by the Inland Revenue Authority of Singapore (IRAS) for the processing and transmission of Assessable Income (AI) to the CPF Board.

The AI for the previous Year of Assessment (YOA) is used to assess one's WIS eligibility for the current year. E.g. we will use your spouse's AI for YOA 2021 to assess your eligibility for 2022 WIS.

-

Why does the majority of the Workfare Income Supplement (WIS) payment take the form of CPF top-ups?

Other than providing a cash supplement to help lower wage workers cope with their daily needs, it is also important to help them build up their CPF savings for their healthcare and retirement needs.I have reached my Basic Healthcare Sum. What happens to the portion of the Workfare Income Supplement payment going into the MediSave Account?

Any MediSave contributions above the Basic Healthcare Sum (BHS) will be transferred to your CPF Special Account (SA) or Retirement Account (RA), which have interest rates equal or higher than that of the MediSave Account. The BHS cap and overflow arrangement are intentionally planned to avoid over saving in the MediSave Account and to supplement your retirement savings.

These overflows which end up in your SA or RA can be withdrawn according to the usual withdrawal guidelines. For members who have met the Full Retirement Sum in their SA or RA, the savings in excess of the BHS will be transferred to the Ordinary Account (OA). Savings in the OA can be used for other purposes such as housing repayment.How can I update my bank account for Workfare Income Supplement?

You may update your bank account details by logging into the Workfare Portal at workfare.gov.sg.

However, please note that if you have a PayNow NRIC-linked bank account, it will be the default mode of payment. You will still receive your payment via PayNow NRIC, even if you change to another bank account on the Workfare Portal.

If you have linked your NRIC number to your bank account after the 16th of the month, or submitted your bank account details after the 14th of the month, your updates will only be effective in the following month.How will I receive the Workfare Income Supplement payment?

From March 2022, the cash portion of Workfare Income Supplement (WIS) will be credited to your PayNow NRIC-linked bank account if you have one.

Otherwise, it will be credited to the DBS/POSB, OCBC or UOB bank account that you have registered to receive Government payments (e.g. either the GST-Voucher (GSTV), Silver Support Scheme (SSS) or WIS, whichever is latest) or credited to GovCash if you had not registered a bank account with us.

Electronic payments make transactions simple, swift, and safe for recipients. We strongly encourage you to consider linking your NRIC number to your bank account or update your bank account to receive your future Workfare payment earlier*.

* If you have linked your NRIC number to your bank account after the 16th of the month or submitted your bank account details after the 14th of the month, your updates will only be effective in the following month.

You will be notified of your payment details via letters and/or SMS messages nearer to the payment dates. To receive your notifications earlier via SMS, please log in to the Workfare Portal with your Singpass and opt-in to SMS at "Notification".How do I encash a Workfare Estate Cheque?

The estate cheque will form part of the deceased member's estate. Depending on the value of the deceased member's estate, his Next-of-Kin (NOK) may apply to the Public Trustee's Office or the Court to administer his estate. For more information, please visit the Public Trustee’s Office website at pto.mlaw.gov.sg, or call them at 1800 225 5529.When will I receive Workfare notification?

You will be notified via letters and/or SMS nearer to the payment dates.

To receive the notification earlier via SMS, please log in to the Workfare Portal with your Singpass and opt-in to receive SMS at "Notification". To receive SMS notifications, you must have a Singpass 2FA mobile number. You will only start receiving SMS notifications after you have submitted the above request and updated your mobile number with Singpass.How can I tell if the Workfare SMS I received is authentic?

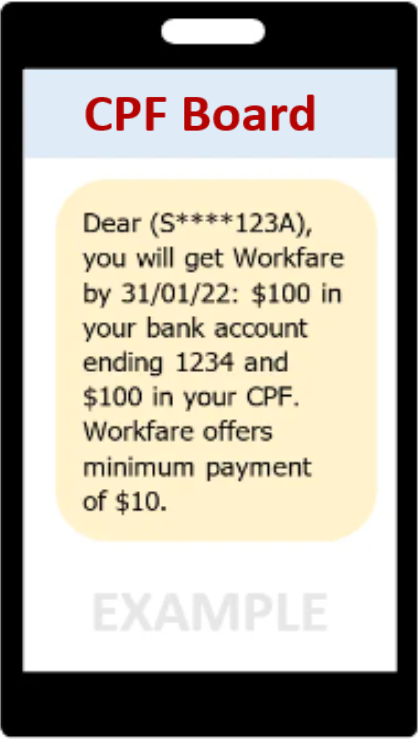

With the recent rise in scam and phishing attempts, it is important to verify that the message received is genuinely sent by an official source.

From 1 August 2022, we will send SMSes from the ID “CPF Board”. The SMS sender ID “SG-Workfare” will no longer be in use.

This is only an example of a Workfare SMS. The actual SMS received may be different.

Here are some tips on how you can protect yourself against phishing SMSes purporting to be sent from CPF Board:

- Check the SMS is sent by ‘CPF Board’ to the mobile number registered with CPF Board. If you are unsure of whether you had registered your mobile number, please login to the CPF website with your Singpass and check your account settings.

- Verify the last four characters of the masked NRIC number are the same as your NRIC number.

- If the SMS contains an URL, make sure that the domain of the URL ends with a ".gov.sg" before clicking on it.

Be Cautious, Pay attention to scam and don't be the next victim of Fraud.Why is the government sending SMS notifications instead of hardcopy letters?

Moving to SMS notifications is part of the Government's efforts to provide timelier and more responsive services to the public. It also allows us to be more environmentally friendly. With SMS notifications, you can quickly and easily receive details of your Workfare payments, including the mode of payment and payment date, instead of having to wait for hardcopy letters.

If you are on hardcopy notification and would like to switch to SMS notification, please log in to the Workfare Portal with your Singpass and opt-in to receive SMS at "Notification".How can I receive SMS notifications for Workfare Income Supplement scheme?

Please log in to the Workfare Portal (Singpass required) and select "Notification". Your selected notification mode will be used for Workfare Income Supplement and other Government schemes (if any) that you may be eligible for.

To receive SMS notifications, register your mobile number with CPF Board via my cpf digital services - Account Settings with your Singpass.How can I provide or update my mobile number to receive SMS notification on my Workfare payment?

We will only send SMS notifications on Workfare payments to the mobile number that you have registered with CPF Board.

To receive SMS notifications, you may update your mobile number via my cpf digital services - Account Settings with your Singpass.I have closed my bank account for receiving Workfare Income Supplement payments. How can I receive the payments?

If you have a valid PayNow NRIC-linked bank account, you will receive your payment via PayNow. Otherwise, you will receive your payments via GovCash. Payments by GovCash take up to 2 weeks longer compared to PayNow.

Please consider linking your NRIC number to your bank account to receive your payments earlier.How much is my Workfare Income Supplement/ Workfare Special Payment?

To check the Workfare payments you have received, log in to the Workfare Portal with your Singpass and look under “Payment History”.What is PayNow?

PayNow is a secure funds transfer service that allows customers to receive money into their participating bank account which is linked to their NRIC. The participating banks in Singapore are as follows (with the corresponding bank code):

With PayNow, the recipient’s bank account will be kept private.Bank Code Bank BOC Bank of China Limited CIMB CIMB Bank Berhad CITI Citibank Singapore Limited/ Citibank N.A. DBS DBS Bank Limited HSBC HSBC Bank (Singapore) Limited/ The Hongkong & Shanghai Banking Corporation Ltd ICBC Industrial and Commercial Bank of China Limited MBB Maybank Singapore Limited/ Malayan Banking Berhad OCBC Oversea-Chinese Banking Corporation Limited SCB Standard Chartered Bank (Singapore) Limited UOB United Overseas Bank Limited How do I link my NRIC to PayNow?

You may follow the steps below:- Set up internet / mobile banking with your bank

- Log in to your bank's internet / mobile banking application

- Link your NRIC number to your bank account at the PayNow registration screen

My mobile number is already registered to my bank account on PayNow. Can the Government credit the Workfare payments to me via PayNow-Mobile instead of via PayNow-NRIC?

We can only credit your Workfare payment to you via your PayNow NRIC-linked bank account. NRIC is an unchanged proxy issued by the Government, compared to mobile numbers which may be easily changed. To ensure that the money is credited to the correct recipient’s bank account, only NRIC will be accepted as the proxy for government payments via PayNow.

Eligible citizens who have linked their NRIC to their bank account will receive the payment in this bank account.What is GovCash?

GovCash is a quicker and more convenient way for citizens to receive their payments from Government agencies as compared to cheque. Singaporeans can withdraw the Government payments in cash from over 500 OCBC ATMs located across Singapore. GovCash is no less secure than receiving payments via cheque. It has adopted the Singpass facial recognition technology to authenticate users, including a liveness-detection capability that blocks the use of photographs, videos or masks during the verification process. Singaporeans do not need to have an OCBC bank account to use the GovCash service.

Previously, cheque recipients would have to deposit the cheques or encash them over tha bank counters. GovCash allows them to receive their payments at the ATM immediately at any time of the day. They are no longer restricted by the bank's operating hours. Singaporeans who prefer to seek assistance with their GovCash withdrawals can visit the ATMs located within OCBC's branches during operating hours, where OCBC Digital Ambassadors will be present to guide them.

In addition, GovCash also allows recipients to use the scan-and-pay function and PayNow transfer option through the LifeSG mobile app.How can I utilise my GovCash?

You can withdraw your payments in cash at OCBC ATMs with your 8-digit Payment Reference Number (PRN), which will be sent to you by SMS or by post. You do not need to have a OCBC bank account to use this service.

You can also transfer your payments to your PayNow NRIC-linked bank account or utilise them to make payments at any merchants or transfer to your friends by scanning their PayNow QR code using the LifeSG mobile app. You can download the LifeSG mobile app from the Apple App Store or Google Play Store.

You may refer to the step-by-step guide for detailed instructions on the ways you can utilise your GovCash payments.Where can I obtain my Payment Reference Number (PRN)?

Your PRN can be found in your Workfare notification from the Board. Alternatively, visit workfare.gov.sg, login with your Singpass and select "View my GovCash PRN".How do I check my GovCash balance?

To check your GovCash balance, please visit any OCBC ATM with your 8-digit Payment Reference Number* (PRN). Upon successful authentication, you will be able to view your GovCash balance.

Alternatively, you may login to the LifeSG mobile app using your Singpass to view your GovCash balance and transaction history. You may refer to the step-by-step guide for detailed instructions.

*Your PRN can be found in your Workfare notification from the CPF Board, and at the Workfare Portal (Singpass login is required).What should I do if my facial recognition at the ATM is unsuccessful?

Should the ATM be unable to verify your identity via Singpass Face Verification, please try again or request for assistance from OCBC's Digital Ambassadors.What should I do if I do not want to receive my payments via GovCash?

You can choose to receive your payments via PayNow by linking your NRIC number to your bank account.

To link your NRIC number to your bank account, you may follow the steps below:

1. Set up internet / mobile banking with your bank

2. Log in to your bank's internet / mobile banking application

3. Link your NRIC number to your bank account at the PayNow registration screen

You may also refer to your bank's website for specific details to do so. If you do not have Internet or mobile banking, you can contact your bank directly to register for PayNow.

Otherwise, you can choose to receive your payments via Direct Bank Crediting. To do so, simply visit here, login with your Singpass, select "Payment Instruction" and update your POSB/DBS, OCBC or UOB bank account details.Why can withdrawals be made only in $10 denominations and what can I do with my balance GovCash?

Currently, the minimum withdrawal amount at the ATMs is $10. Hence, GovCash withdrawals can also be made in $10 denominations. If the balance in your GovCash is less than $10, you can accumulate your balance monies before your next withdrawal.

Alternatively, you can also transfer the balance to your PayNow NRIC-linked bank account or utilise them to make payments at any merchants or transfer to your friends by scanning the PayNow QR code using the LifeSG mobile app. You may refer to the step-by-step guide for detailed instructions.Would I need to login to Singpass each time I open the LifeSG mobile app to access my GovCash?

No, you are only required to log in using SingPass when you first use the LifeSG mobile application. Subsequent use of the LifeSG mobile app do not require SingPass logins again, unless you have not used LifeSG mobile app for more than a year or deleted the application and re-downloaded it.If my GovCash balance is insufficient to make payments at the merchants, can I top-up using my own funds?

Topping up your GovCash balance in the LifeSG mobile app is not available. For purchases of amounts above your GovCash balance, please pay the difference using other payment modes that the merchants accept (e.g. cash, debit/credit cards).How do I know if the SGQR displayed by merchants includes NETS QR and PayNow QR so that I can make purchases using my GovCash balance?

Look out for the NETS or PayNow logo on the SGQR label. You can only make purchases at merchants that accept NETS QR or PayNow QR code via LifeSG app.Can I cancel my payment after I have confirmed the payment on the LifeSG mobile app?

No, your GovCash balance will be deducted upon successful payment.How do I get a Singpass account?

To obtain a Singpass, you can either:- Visit Singpass website to apply for your Singpass online or

- Visit any of the Singpass counters located islandwide in-person.

How do I change or reset my Singpass password online?

To change or reset your Singpass password, please complete the following steps:

- Visit Singpass website

- Select 'Log in'

- Select 'Reset password' (under the 'Services' tab)

- Follow the instructions on the website to complete the changing or resetting of Singpass password